Types of BNI Cards and Their Transfer Limits

Who doesn’t know this one national financial institution? Yes, BNI is one of the providers of banking service and is also one of State-Owned Enterprises (BUMN). The number of BNI customers is also very large in Indonesia. One of the factors is the easy registration for the BNI debit card and its savings account.

For your information, BNI as a bank financial service has introduced various types of debit cards that can be tailored to the needs of its customer when conducting various types of transactions. If you are interested in saving and want to own a BNI debit card, you need to know the types of the cards and the transfer limits. This surely will make it easier for you to adjust it to your needs.

List of BNI Card Types and Their Transfer Limits

BNI introduces 6 types of debit cards that you can choose according to your needs. The descriptions are as follows :

- BNI Silver

- BNI GPN

- BNI Gold

- BNI Platinum

- BNI Taplus Muda

- BNI Garuda

This type can be said to be one of the most used types of BNI debit cards and is well known by many people. Just as the name suggests, the color of this card is gray or silver with a batik drawing as an aesthetic addition which makes the card look more beautiful. The BNI Silver admin fee is IDR 4,000, the interbank transfer limit is IDR 50 million, the transaction limit is IDR 25 million, and the cash withdrawal limit per day is IDR 5 million.

Currently, BNI has issued a GPN debit card or the National Payment Gateway debit card. This type of card which has the GPN logo on it provides transaction benefits and administrative costs that are more affordable for all of its customers. The cash withdrawal limit is IDR 15 million, the transfer limit between accounts is IDR 100 million, and the interbank transfer limit is IDR 25 million.

BNI Gold cards are characterized by the golden and yellowish colors. If you feel that the BNI Silver card doesn’t meet your needs, then BNI Gold can be the best choice. The process of getting this card is also very easy, you only need to open a BNI Taplus or BNI Taplus Bisnis savings account. The transfer limit between BNI accounts from BNI Gold is IDR 100 million, the interbank transfer limit is IDR 25 million, and the administrative fee required is IDR 7,500.

People nowadays call this type of card “black card” since it occupies the highest level of all types of cards. Same with BNI Gold, you must be a customer of a BNI Taplus or BNI Bisnis account to own this card, both for individuals and for non-individuals. Included in the category of debit card type with the highest tier, this card has the highest monthly fees and transaction limits as well. The transfer limit between BNI accounts is IDR 100 million, while the interbank transfer limit is IDR 25 million. The administration fee is IDR 10 thousand per month.

Are you 17-35 years old? BNI also offers the Taplus Muda debit card that can be a good choice for you. There are three versions of BNI Taplus Muda card, namely regular, music, and sports. This card has an interesting appearance because a personal photo of its customers can be printed on the card. The initial deposit is also the lowest, which is only IDR 100,000, so it is very suitable for students. BNI Taplus Muda transfer limit between BNI accounts and interbanks is IDR 10 million a day.

Last but not least is the BNI Garuda card. The characteristics of this card are the black color and the MasterCard and Combo logo so it can be used for TapCash transactions as well. If you want to open a BNI Garuda account, you must first have a BNI Taplus or BNI TABI savings account. Then, you will also be given a BNI Garuda debit card. The BNI Garuda card transfer limit between BNI accounts is IDR 100 million a day and the limit for interbank transfers is IDR 50 million a day.

Do you want to receive BNI virtual account payments directly on your website or online app? If you do, it won’t take long and it does not need much work to do because the only thing you need to do is to connect your website or online business app to Duitku.

Duitku as an Indonesian payment gateway can accept payments via BNI bank transfers, credit cards, debit cards, and various other payment methods (bank, e-wallet, retail, credit card, etc). Duitku provides various payment methods both online and offline so that the transaction process will be easy, fast, and secure. All transactions will be recorded automatically when you use Duitku. Therefore, you don’t have to hesitate to use the Duitku payment gateway right now.

Let DUITKU take care of all your transactions!

Get Your Online Payments at Indomaret Retail Outlets via Duitku.

Despite the ever growing application of online payments in Indonesia, there are a number of Indonesia’s population who still feel more comfortable paying directly in cash. Although 70% of the population has internet access, 66% of Indonesians do not have a bank account.

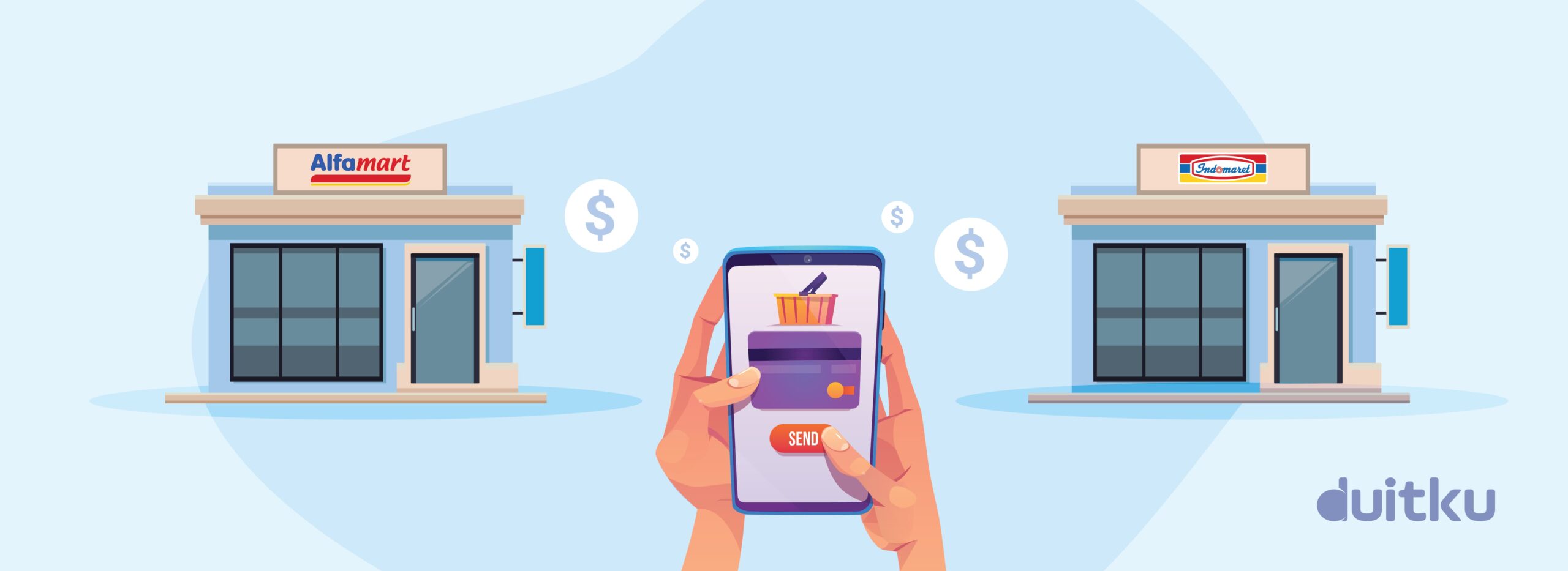

As an answer to that, Duitku has collaborated with Indomaret to facilitate your online business payments. Now, customers who do not have an e-wallet or a bank account can pay for your products at almost 19,000 Indomaret outlets spread throughout Indonesia, besides Alfamart, Pos Indonesia, and Pegadaian outlets.

How do we activate the Indomaret payment line on Duitku?

Saat ini, jalur pembayaran Indomaret dapat digunakan oleh seluruh merchant dengan status memiliki badan usaha / perusahaan.

Right now, all merchants can use the Indomaret payment line as long as you have a business agency or a company.

To activate the payment method at Indomaret retail outlets, please send an email to [email protected] and inform your email address that you use and your website project code where the payment method will be integrated.

After that, the Duitku Team will immediately process your application to Indomaret. This process can take up to 30 days. For now, the payment method at Indomaret retail outlets can only be used by merchants who have a business agency or a company.

If my request is accepted, do we have to do an integration again?

For those of you who have websites on Woocommerce (WordPress), Magento, Virtuemart, Opencart, Prestashop, WHMCS or JoomShopping platforms and integrate using plugins, you can download the latest versions of our plugins on the Duitku API page. Update the plugins that you installed through your website platform dashboard with the latest version of our plugins to get the Indomaret payment method option in it.

For merchants who need a more complex integration process and integrating with the API, payment method integration can be processed by adding the integration code “IR”. Check out for more info on the Duitku API Documentation

How to Pay Online Shopping Bills at Indomaret Outlets?

The service fee is MDR + Rp. 1,000,- (including VAT) / transaction.

For normal prices (without a special MDR by Indomaret), the cost is around Rp. 7.500,- (including VAT) / transaction.

You can check here to see the prices for other payment method services.

Duitku does not charge registration fees or maintenance fees. All fees are based on the amount of (bank transfer, retail outlets) or nominal of (e-wallet, credit card/installment) the transactions.

How to Pay Online Shopping Bills at Indomaret Outlets?

- Write down and save the payment code displayed on your payment page

- Come to Indomaret / Ceriamart / Lion Super Indo retail outlets near you

- Inform the cashier that you want to make a “Duitku Payment“

- If the cashier says they do not provide payments for “Duitku“, you can inform them that this payment is a Payment Point in the “e-Commerce” Category.

- Show the Payment Code to the Cashier

- Make the payment according to the nominal informed and wait for the process to complete

- Request and save the receipt as a payment proof

- Your payment will be detected automatically

Reach more customers by providing payment channels through Indomaret, the retail outlet with the largest network in Indonesia.

For more information please contact us via email [email protected] or live chat on the Duitku Dashboard.

Let Duitku take care of your transaction!

Business Opportunities in the Trending Online Grocery Shopping

Almost everything has now implemented digitization. So does shopping for daily necessities (grocery) which now can be done online. Online grocery services make it easy for us to order daily necessities such as vegetables, fruit, and various other types of food. Only through apps that are connected to internet access, daily needs can be fulfilled without us having to leave the house.

This trend of online grocery service is on-demand, where there is an order, the courier will deliver it within a predetermined time to maintain the material’s freshness. Currently, there are many online grocery platforms that allow us to connect directly with the courier.

Online Grocery Business Opportunity

In Indonesia, the market share of the online grocery business still only exists in big cities, especially areas close to the capital city. However, this does not rule out the possibility that the online grocery business will continue to expand to other areas. Data from The Institute of Grocery Distribution ASIA states that the online grocery market is predicted to grow by 198% in 2023.

The region that is projected to become the center of the fastest growing online grocery market is Southeast Asia, although its value is not as big as China, Japan, and South Korea. The Indonesian market is predicted to grow because it is considered to have an important scale for business owners. In Indonesia, the concept of online grocery has been started since 2013, where the Seroyamart brand emerged which presented a similar concept in the market.

In the following year, various newcomers such as Honestbee appeared, but only lasted for 1.5 years. Since then, various new brands have emerged, such as HappyFresh, SayurBox, Go Mart, Hypermart, and Grab Fresh, which are still there to serve the public with the online grocery concept. Each of them also has a strong business backing.

The Business Soars Thanks to the Pandemic

Various products that can be used online business ideas during the covid-19 pandemic. The pandemic seems to have its own blessing for online grocery businesses. As we know, one way to prevent the transmission of Covid-19 is to do physical distancing and to lessen outdoor activities specially, in public places, one of which is the market. With online grocery, we no longer need to jostle in the market or to do physical distance with other people, which is surely a difficult task to achieve in such places.

The presence of online grocery stores has helped reduce mobility, which of course has a positive impact on the decreasing number of cases of Covid-19. Those who have to self-isolate can still fulfill their daily needs with online grocery.

Several e-commerce companies have also started adding a grocery category to their services, like Lazada. Local companies like Blibli also don’t want to be left behind. It presents the grocery concept on Blibli Mart. Looking at this phenomenon, the projection of the online grocery business seems to have a bright future. Moreover, people’s shopping habits are now increasingly dependent on digital.

Online Grocery Shopping Tips

Compared to having to shop directly at the market, shopping through online grocery is quite practical and easy. For those who are busy, online grocery can be a savior when all their daily needs are running low. We also don’t need to queue when shopping online for groceries.

It is fast enough to do through a special app or platform, and the couriers will be ready to deliver all our daily needs. However, we must apply some special tips when we do online grocery shopping so that it won’t cost us any loss. Here are some tips to a success online grocery shopping:

- Choose a trusted market

- Buy as needed

- Take the benefit of discount

- Choose a market with good quality service

When shopping for groceries online, choose a trusted market so that the products you buy are of high quality. To find out the credibility of the market, you can visit its official website and see their customer testimonials.

It is important to buy what you really need when you shop. Avoid buying something just because you want it or just because you are tempted by the cheap price. It will only make your money go to waste and your needs might not be fulfilled properly.

When you are about to shop, you can check whether the online grocery market offers promos or discounts on the products you buy. Take the benefit of this for your budgeting.

Make sure the online grocery market you choose has good quality services, so that the goods or products you buy can arrive on time and complete.

Online Grocery Business Tips

Seeing the great opportunity of online grocery business, no wonder that there are many people who want to explore the business. If you are one of them, here are some tips for starting an online grocery business:

- Prepare the capital

- Find suppliers

- Promotion

- Give good quality service

When starting any business, including online grocery, you have to calculate the amount of capital needed. The main capital when creating an online grocery business is used for vendors to create websites or apps to connect you with customers.

It is best for you to look for vendors with affordable prices but good quality work. You can also use free sites to create your own website such as blogspot or wordpress. In addition, you can use social media such as TikTok Shop to connect with buyers or customers.

After calculating the capital, you need to find a supplier who provides good quality products with cheap prices. This can be done by surveying the market directly to find out the quality and price in the field. After finding the suitable one, you can subscribe to that supplier.

Promotion is an important step in doing business. You can use social media to promote the online grocery business you just built. The trick is to create unique content to introduce your business.

Promotion through social media can reach more people than conventional promotions like brochures or flyers. You can also try to attract potential buyers by offering discounts or free shipping.

When your online grocery business starts, you have to provide good quality service. Make sure the products brought to customers are fresh and high quality products. You also have to deliver the product on time so that customers won’t be disappointed.

After you have done the tips above, the last step is to connect your online grocery website or app with a payment gateway system like Duitku. Why is that? Since online grocery provides fresh ingredients, the ordering process, payment and delivery must also be processed quickly.

This is in line with the Duitku service which will facilitate your customers to shop and transact 24/7 easily. With an automatic transaction checking system, your customer orders will be processed faster for delivery.

Let’s automate your online grocery business with DUITKU!

Know These 5 Ways to Transfer Money to Bank Accounts without Using an ATM

Transfer according to KBBI means to move or change places. In the financial sector, transfers are remittances that will be received by the bank, including the proceeds from collections that are billed through the bank, which will later be forwarded to the bank or another account to be paid to the customer. Basically a transfer is a service provided by a bank to facilitate certain funds in accordance with customer orders intended for transfer recipients.

Usually people will go to ATMs to make transfers to other people’s accounts. However, there is also a way to transfer money to a bank account without using an ATM that you can do every day. This of course can be adjusted to the needs and can facilitate the transfer transaction process for all customers.

These different transfer methods can of course be adjusted to the needs of customers who want to send a certain amount of funds to the recipient of the funds. In addition, transferring money without using an ATM machine can also be the best solution if you don’t own a bank account.

Then, how to transfer money to a bank account without using an ATM? Below are 4 ways to do it.

- Cash Transfer Via Teller at Bank

- Ask for the account number, bank name, and the name of the recipient of the transfer funds.

- Prepare the cash that will be sent and also your original identity card.

- Come to the bank according to the bank account information of the recipient.

- Take a queue number, then fill out the remittance form.

- Submit the form to the bank teller to process the transfer.

- The money will be directly received in the recipient’s account.

- Transfer Via Western Union

- Transfer Via Kantor Pos Indonesia

- Wesel Pos Instant is the fastest delivery because it is real time using a PIN and NTP (Central Transaction Number) which is sent directly by the sender to the recipient of the funds.

- Wesel Pos Partnership is a type of draft that is the result of cooperation with other parties or third parties. The rates will be adjusted according to the existing agreement.

- Wesel Pos Cash Transfer (Cash to Account) is an option for sending cash through the Post Office to all bank accounts that can be done in real time.

- Wesel Pos Prima is a money order service that can use a notification letter and be delivered by the Destination Post Office to the recipient of the funds.

- Transfer Via Minimarket (Alfamart and Indomaret)

- Tell the cashier that you want to send some money.

- The cashier will ask for your ID and your phone number, don’t forget to also prepare the recipient’s information. For transfers at minimarkets there is an additional administrative fee that you have to pay.

- Wait for the cashier to complete the transaction process, if it is successful you will get an automatic SMS

- In the message there will be a money transfer code that you can send to the recipient.

- Transfer Via E-Wallet

The first method is certainly the most common and widely used to send large amounts of money or it can also be done if you don’t have a bank account. Transferring money through a bank teller is also known to be quite easy. The steps for cash transfers through bank tellers are as follows:

Besides that, you can also use this method of sending funds to deposit some funds and send them to your own account for saving.

The second is transferring money through Western Union. As a money transfer service with a network spread throughout the world, Western Union can certainly be the best solution for you to send funds without using an ATM. Therefore, many people use this money transfer service when living abroad. The advantage of using Western Union is that the money you deposit at one of its branches can be taken directly at other Western Union branches around the world. Interesting, isn’t it?

Now you can use the post office to send money besides sending letters or packages. The money transfer service offered by Pos Indonesia is known as a money order service. Here are some types of money orders you can choose:

Receive Payments through 24.000 Post Office Outlets All Over Indonesia.

Not only providing daily needs, Alfamart and Indomaret currently offer money transfer service. Here are the transfer procedures at Alfamart and Indomaret:

The next money transfer without an ATM is through an e-wallet. As we know, e-wallet apps are now widely used by Indonesians. These apps provide convenience for transactions, especially for those of you who do not have a bank account. Not only can it be used to transfer funds to other users of the e-wallet app, now you can also transfer funds from the e-wallet to a bank account.

With the e-wallet , you can transfer funds more easily without having to go to an ATM. Money transfer has become easier because it can be done anytime and anywhere using only a smartphone.

Those are some ways to transfer money to bank accounts without using an ATM you can do. In addition, various types of transactions can also be carried out by Duitku easily. This Online Payment Gateway in Indonesia can accept payments directly on your website or online app via bank transfer, credit or debit card, virtual account, e-wallet, and major retail outlets.

You can also use Disbursement by Duitku to send some money to banks throughout Indonesia, e-wallet, or send cash through Pos Indonesia and retail networks. It definitely will make it easier for you to send money to your business partners to process employee salary payments. Duitku’s service for sending funds and receiving payments will also help you in processing and reducing errors in entering your transaction data.

So, by using Duitku, the transfer process can be done quickly and easily. You also don’t need to worry about security, because Duitku has been trusted by many well-known companies in Indonesia.

Let DUITKU take care of all your transactions!

How to Make a Website for Donation

Currently, many websites and apps have emerged to facilitate human activities. One of them is an online donation website which now has been increasingly growing. The emergence of the donation website has helped build human awareness about the importance of helping others and protecting the surrounding environment. Therefore, more and more people are now supporting the various ongoing funding programs.

Online donation websites are now the choice when you need a quick fundraiser. Also, this internet fundraising campaign can be carried out by anyone, from companies, foundations, to individuals. The use of online donation websites is for various purposes, both for humanitarian purposes or for environmental purposes

The Advantages of Online Donation Website

Compared to conventional fundraising, online donation websites provide the following advantages:

- Transparent

- Easier and Faster Process

- Reach More People

Transparency is important in fundraising. When a fundraising achieves its target quickly, the transparency is often being questioned. By using the donation website, you can include reports of receipts and use of funds in an easy and practical way.

When you want to raise funds quickly, an online donation website can be your consideration. Fundraising campaigns can be done on the internet without having to go door to door. Moreover, currently there are so many internet users so that the results obtained can be more leverage than conventional fundraising.

Anyone can collect funds through the website, from foundations, institutions, to individuals. The payment methods offered are also varied, making it easier for people who want to donate.

Using a donation website can reach more people. You are not only raising funds from the closest people, but you can also raise funds from people in various regions. All you have to do is share the donation page on social media so people can access it easily.

How to Make a Website for Donation

There are three ways to create a donation website. Here’s how:

- Via WordPress

- User registration, submission form, project start and end dates

- Pricing options and funding objectives

- Project update options

- View pictures and videos

- Reward system with delivery date

- Distribute all funds via PayPal, Stripe Connect, Skrill, Authorize.net and more.

- Centralized real wallet system: Project owner can send withdrawal request to admin after collecting some money.

- Analytical reports

- Email notifications

- Reporting

- Social sharing

- First :

- Second :

- Third :

- Fourth :

- Fifth :

- Via PHP and SQL

- Donation Platform

f you want to create an online donation site via wordpress, you can use the WP Crowdfunding plugin. The plugin also has a wallet system to accept local payments and share money via Stripe Connect or Paypal. WP Crowdfunding also has many excellent features such as:

WP crowdfunding also provides premium features such as:

How to make it?

To create an online donation website through wordpress you can use the WordPress Self Hosted CMS tools or software. After that, follow these steps:

The first thing to do is login to the WordPress dashboard. After that, download the WP crowdfunding plugin.

The second step is to install the plugin. After that, we can immediately activate the plugin.

Once it is active, the plugin will automatically create four pages. You can find it in the “All Pages” section of the menu. The four pages are new user registration, list of approved campaigns, user account dashboard, and page to create fundraising campaigns.

In the Woocommerce settings section, change the Select Listing Page and Select Registration options. For other options, you can change it as needed.

In the style and social share features, adjust the menu as needed. Then set the donation page layout in the website layout section.

Besides wordpress, you can also create a donation website through PHP and SQL. PHP was originally created as a collection of scripts to process form data on websites in 1995. After that, PHP was developed again into a sophisticated programming language. Currently, PHP has become a global level web server standard.

In order for PHP to work perfectly, you can pair it with MySQL. MySQL is a software for database management system that can be used to access and process data. So, PHP and MySQL must be connected in order to process data from the browser to the web server. PHP works by alerting MySQL when a user searches for donation data in the database. After that, MySQL will find the information to the server. Then the server will forward the information to the browser so that it can be accessed by the user

If you want an easier way to make an online donation, you can try making it through an online donation platform. One of the most widely used online donation platforms is Sociabuzz. To create an online donation site through sociabuzz, we simply need to visit the official website.

After that, you have to register an account at Sociabuzz which can be done for free. If you are already registered, you can go to the profile page and complete all the required data, including uploading a profile photo.

Then copy the existing link and share it on social media. You can also make donation choices through the “Edit Page” feature and then select “Add Support Options”. This step is the easiest way to create an online donation site because you don’t need to have web design or complicated programming languages skills

So, that’s how to create a website for donation. Don’t forget to add a payment gateway feature on your donation website. This feature is to make it easier for donors to send their funds. That way, your website can accept payments from a variety of available payment method options.

Duitku as a trusted payment gateway in Indonesia is ready to assist you in accepting donations from all over Indonesia with various payment methods. Starting from payment methods via retail outlets (Indomaret, Alfamart, POS, Pegadaian), via virtual accounts, e-wallet and so on. Let’s facilitate donors to do good by using DUITKU

What is Chargeback and How to Avoid It?

When one uses a credit card as a payment method, there are sometimes problems during the payment process. One of the problems that usually occurs is chargeback. What is chargeback? The term chargeback means that there is an amount of money that is being held by a bank due to a dispute during a transaction using a card. For online sellers, this condition definitely can hinder the payment process.

1. Get a Better Understanding about Chargeback

When shopping online, buyers usually make transactions using a payment system via a bank, either by direct debit or a credit card. However, payment methods made via banks or by transfer systems sometimes have a problem, like chargeback, that are detrimental to business owners or sellers. This condition of chargeback can occur accidentally during the transfer process.

There are several things that cause a chargeback, such as transaction errors and when there is a difference between the signature on the receipt and the signature on the credit card.

The bank will stop the transaction process if there is a difference in signatures to prevent transactions carried out not by the real credit card holder. The occurrence of a chargeback can also be due to an error in the date or nominal, or repeated transactions (double transactions). In addition, chargeback can also occur when credit card holders feel dissatisfied with the quality of the goods they bought so they issue a complaint to the bank.

This condition can be solved by submitting a report to the bank, so that the money is no longer held by the bank, though sometimes this reporting process takes time so buyers and sellers can sometimes experience some losses before their money comes back.

2. Disadvantages from a Chargeback

This condition where some amount of money is being held by a bank causes the payment that should have been received into your bank account eventually canceled due to a chargeback. As a result, your financial records could become rather messy, because the money is stuck and even worse, it could stagnate your business. This, of course, does not only reduce your profits, but also your income. Therefore, it is very important to avoid chargeback risk reported by the buyer that can disrupt your business from running smoothly.

3. How to Avoid Chargebackk

There are several things you can do to avoid a chargeback that can cause you a loss as a seller or a business owners:

- To minimize complaints from buyers, they must pay attention to all the information that appears in their invoices. Such as the nominal, the source of the withdrawal of the money, and the date of the transaction being made before they continue the payment process. Buyers have to ensure that the information displayed at checkout is transparent and clear.

- Make sure the seller provides detailed information regarding the product being sold. The product descriptions, images and features must be in accordance with the real condition of the products. Sellers must also respond to product information questions by the buyer.

- Explain what terms and conditions apply on your invoice and website in case you have to refund or when buyers want to return the products.

- Recognize and be aware of signs of credit card fraud by checking the original address of the card registered by the buyer, especially if they make a large order. It is recommended to send an email to confirm the status of the order.

- Keep all transaction history and communications with buyers, so when you file a report, you have solid evidence to protect you against credit card chargebacks.

- It is recommended to provide a safe and realistic estimated delivery time. Use a trusted expedition service that has an online tracking service. Add insurance service if you want an extra security system, so that buyers will feel more secure about their purchases.

- If the dispute is caused by the buyer’s misunderstanding, make sure you, as a seller, understand the problem. You must also offer a solution that is acceptable to both parties to avoid a credit card chargeback report.

- Using a fraud detection system. You can ensure that the credit card received has used a 3D secure authentication code to ensure that the card user matches the registered card owner. Banks use this security system as a proof of chargeback protection for credit cards.

To receive payments from credit cards safely and directly on your website or online app, you can use a payment gateway service. But make sure the payment gateway you are using has a PCI-DSS certificate (international security standard for managing credit card transactions), and is equipped with a fraud detection system (FDS). By using a payment gateway with a good FDS, you can protect your online business from theft or fraud by setting the nominal transaction limit, selecting the allowed transaction region and blocking suspicious card numbers.

One of the best payment gateway services that has a license from Bank Indonesia and has a PCI-DSS certificate is DUITKU. Besides accepting payment systems using credit cards, Duitku also facilitates customers to pay using various other methods such as e-wallet, bank transfer, retail outlets (Indomaret, Pos Indonesia, Pegadaian, Alfamart), installments without card, or other payment methods. You can choose the payment method you want to provide for your customers on the Duitku dashboard.

By integrating a payment gateway service to your website, you can process payments in real time automatically. The secure, fast and easy transaction payment process provides a pleasant online shopping experience for customers, and therefore can encourage customers to make product purchases.

Start accepting payments via credit card using Duitku payment gateway now and let us take care of your transaction!

Virtuemart vs Magento, Which One is Better?

When we start an online business, we are definitely faced with a choice between virtuemart or magento. Both of these tools are very useful in managing online business operations. Starting from stock management, product catalogs, or shopping carts, everything can be done easily through the operation of these tools.

But when asked to choose between magento or virtuemart, most people find it difficult to decide. Actually, each of these tools has its own advantages and disadvantages. All we need to do is adapt its usage according to our business needs. Therefore, we must know all of them well before choosing one of the two.

Get To Know About VirtueMart

VirtueMart is a free, open source e-commerce tool for Content Management System (CMS). VirtueMart was first created in 2009 by Sören Eberhardt-Biermann. We can say that VirtueMart is a popular plugin nowadays.

This free plugin enables the Joomla content management system to be a very useful and powerful open source e-commerce solution. VirtueMart is made in PHP format using a MySQL database for its backend. It can be used in two different modes, namely shopping carts and catalogs.

The shopping cart mode offers everything you need to operate a complete online store such as product catalogs, shopping carts, and payment/payment processing workflows. Meanwhile, catalog mode is designed only to showcase products, so customers cannot make direct purchases with this mode.

VirtueMart’s Main Features

VirtueMart is fully featured and easy to use for both beginners and experts. VirtueMart’s main features include:

- Product Management

- Product Search

- Integrated Product Reviews

- Inventory Management

- Order and Purchase

- Order Status

- Customer Form

This feature can help you edit products, list or categorize products. It also allows you to edit the tax calculation rules.

VirtueMart includes many different features designed to make it easier for you and your customers to find what they are looking for. You can create product lists and organize them as you wish.

This feature makes it easy for users to leave ratings and reviews on items you have sold.

To help manage inventory, VirtueMart provides reliable backend tools to track items you have in stock, items that have been sold, and items that have been ordered but not yet received.

This feature allows users to perform shopper management, allowing you to group customers. You can also keep records and offer tax reporting features so that it can automatically generate tax records.

This feature helps customers stay up to date on the status of their orders. Has it been packaged, has it been on the expedition, has the order arrived at which location and so on.

This feature helps you in collecting data of potential customers.

What is Magento?

Magento is an e-commerce platform built on open source technology. This tool provides flexibility and control over the appearance, content and functionality of an online store. Magento offers search engine optimization, and catalog management tools. With Magento, you can create an online store as you want. This tool provides complete control options so you can design a user-friendly web and maximize the use of SEO.

Magento’s modular architecture is also very flexible, making it easier for you to meet your online store needs. Currently, there are more than 5000 extensions available on the Magento Marketplace, from payments to marketing. Popular brands like Nike and Canon also use Magento for their websites.

Main Features of Magento

Magento also has an intuitive dashboard with full features for managing an online store. Magento’s various features include:

- Customer service

- Payment

- Security

- Marketing

- Accounting and Finance

- Delivery and fulfillment

- Website optimization

Magento is designed to be used as an app by someone who has no experience as a developer. Therefore, this tool is very easy to use by beginners. It can be used by various types of businesses, both small and large scale. Magento also offers free Magento Open Source and feature-rich Magento Commerce. In other words, these tools can grow and develop according to your business.

Between Magento or VirtueMart

Both Magento and VirtueMart have their own advantages. You can use one of them according to your business needs. However, when choosing between Magento or VirtueMart, there are several aspects you should consider. Here are the things to consider when choosing between Magento or VirtueMart :

- Installation

- Ease of Use

- Search Engines

- Cost

- Customization Ability

To install Magento manually, you have to download a special package and load it into the hosting account you have provided. Virtuemart is basically an extension for Joomla systems, so you can install it easily.

Magento is a very powerful e-commerce platform, equipped with many options for customization and advanced use. If you are familiar with web design and Web programming, Magento can be a good choice. However, Virtuemart is just a plugin, which makes it much easier to use than Magento.

Magento is one of the top ranking platforms for easy integration with SEO. From custom URLs to meta descriptions, search analytics, and integration with Google, you can customize your store data with all of these features. With Virtuemart, you can find extensions that help with SEO.

Both can be downloaded for free. However, Magento is slightly more expensive than Virtuemart if you intend to build a large store. Because, you have to make a payment when you want to add special features.

Magento is customizable and is a great choice for those of you who have the skills to learn web design and development. This e-commerce platform is one of the most flexible and adaptable, but there is a requirement for some technical knowledge to use on your website. Virtuemart is a more basic and simpler platform making it suitable for beginners.

You can also integrate your website and online store app with Magento and VirtueMart through payment gateway systems like Duitku. Duitku has provided plugins for both in an easy way. How to integrate VirtueMart with payment gateway Duitku, Magento and many other plugins have been prepared neatly so that the steps can be followed easily. Click here to learn more about the plugins provided by Duitku.

By using Duitku, your website and online store app will also have other interesting features. Starting from the automation of customer payment transactions, security against fraud, a user-friendly payment system so as to increase customer experience.

So, what are you waiting for? Just leave all your transaction matters to DUITKU!

Accept Payments on the Moodle e-Learning Platform with Duitku Payment Gateway Plugins

Currently, daily activities have started to return to normal, but there are some habits formed during the pandemic that we are still implementing today. One of them is E-learning or online learning, where many people develop online-based learning platforms to support needs in the education field. With the development of technology, making online learning classes or E-learning is no longer a difficult thing because now there are many technologies that can be used to make an interesting E-learning.

LMS or Learning Management System is one of the software that can be used to support educational technology. This LMS itself is often used by educational institutions, companies, and also online course institutions.

What Is LMS?

LMS or Learning Management System is a system to help you design web-based e-learning apps and manage all the content in it. Actually, an LMS is a CMS (content management system) like WordPress, Wix, and others. However, LMS is more specifically designed to facilitate e-learning.

Get To Know More About Moodle

One of the most widely used LMS is Moodle, which is an online-based educational service platform that offers many advantages in terms of its use. Moodle is known as a free and open source LMS platform. So, Moodle’s license is free for all users. In fact, users can also develop Moodle according to their needs. Therefore, if you want to create an educational app such as e-learning, then you can choose Moodle as the best option.

Moodle has 3 variations, namely Moodle.com, Moodle.org, and Moodlecloud.com. These three types of models have their own distinct points as follows:

- Moodle.com

- Moodle.org

- Moodlecloud.com

Moodle.com is a commercial product of Moodle HQ. Moodle.com is the place where you can get details about Moodle Partners in your country and what commercial services they offer.

Moodle.org is a community website for MoodleProject. You can download the source code and plugins from the website. On Moodle.org you can also find a Moodle support forum that will help you find solutions to your problems using Moodle.

Moodlecloud.com is a free portal created by Moodle HQ. With this portal, you can build your own online learning site for free. If you create a portal with Moodlecloud, you will get a URL like http://www.(websitename).moodlecloud.com/. Then, your learning materials will be hosted by the Moodle server. This can be the best option for organizations and institutions that don’t have a big budget.

If you want to create an e-learning platform to distribute your online classes, make sure you can provide access to every customer easily. One of them is by automating the payment process so that users can get access right away after making the payments. This absolutely will also increase the transaction experience and customer satisfaction with your product.

Payment gateway is one of the technologies that can support the payment system on your website or online app. You can connect your platform with a payment gateway service. A payment gateway connects your website to various banks and financial service institutions so that you can receive payments in real time.

One of the Indonesian payment gateways that can be used to support your e-learning platform is Duitku. Licensed by Bank Indonesia, Duitku has collaborated with various banks and financial institutions to provide 24+ payment methods to facilitate platform users accessing your online classes, from bank transfers, e-wallet, credit cards, to pay later services.

For those of you who use a Moodle-based e-learning platform, Duitku also provides plugins that can be directly installed via the Moodle dashboard to facilitate your integration. You can receive payments directly on your Moodle platform without having to integrate through an API coding.

Duitku provides 2 Moodle plugins that can be customized according to your needs, namely Payment on Enrollment and Payment Account. Here are the differences.

| Enrolment | Payment account |

|---|---|

| Money collected in 1 account | Collected money can be grouped based on the class/bundle purchased |

| Suitable for websites that are run by 1 administrator/platform owner and no funds distribution. | Suitable for collaborative websites, where the classes or modules available become the rights of different parties. |

| Managed from the menu Site Administration > Enrolments | Managed from the menu Site Administration > Payment Gateways |

Here are the steps to integrate the Moodle plugin in Duitku:

- Installation

- Download the Moodle Duitku plugin according to your needs here

- Login to your moodle with the admin account > Site administration > (tab) Plugins

- Click install plugins

- Select Install plugin from ZIP file and upload the downloaded Duitku plugin (ZIP) file.

- Select Continue and the plugin will be installed immediately

- Duitku Configuration

- After the plugins are installed, go to the Site administration page, click General > Payments > Payment accounts.

- Duitku will appear in one of the payment options. Click Duitku.

- (If it doesn’t appear, please activate it first on Site administration page > (tab) Plugin > Payment gateways -> Manage payment gateways. You will see Duitku with a crossed eye logo. Click the logo until it displays the eye logo only. Return to the payment account page.)

- In your Duitku payment account, you can enter the name of your payment account. Click the checkmark ‘Enable’ to activate the payment.

- Enter the API Key and Merchant Code that you get on the My Project page Duitku dashboard. Check how to get the API Key here.

- Set your moodle’s Expiry period and environment.

- Click the Save changes button to save the settings. Payment gateway configuration has been completed.

Currently, the Moodle platform has not provided payment transaction-specific reports yet. However, purchases on your Moodle platform will be recorded along with changes on other platforms via the Reports > Live logs menu tab

If you want to see your sales report, you can access the transaction report via the Duitku Dashboard. Every transaction, whether it is just an inquiry or one that has been paid, will be directly recorded on the Duitku Dashboard, and you can filter them according to your needs.

With a plugin compatible with the Moodle platform, you can receive payments in real time with just a few clicks. Make sure payment transactions on your platform run smoothly 24/7 to improve the learning experience and user satisfaction of your e-learning platform with DUITKU payment gateway.

Startup Ecosystem: Definition and How to Build It

The Global Startup Ecosystem Report 2022 data states that Indonesia occupies the second position in the Top 100 emerging startup ecosystems. This has proven that Indonesia has great potential in the digital economy. This also shows that Indonesia has become a target country for investors to invest their assets, especially in the startup companies.

After Singapore, Indonesia is indeed looking for the most attractive market for businesses in Southeast Asia due to the growth opportunities of its dynamic startup ecosystem. Because the startup ecosystem is considered good, the IMF and the world bank also project that the economy in Indonesia will become a giant at number 5 by 2024.

What is the Startup Ecosystem?

A startup ecosystem is a group of people, startups, and related organizations that work as a system to create and scale new startups. Startup ecosystems often form in relatively limited areas such as universities or technology companies. This ecosystem brings together key actors and stakeholders interested in startups. This includes new entrepreneurs, mentors, incubators, investors, and support services such as startup-savvy law and accounting agencies.

The startup ecosystem supports all entrepreneurs. Some startups move to new locations simply because the ecosystem there is better. The startup ecosystem can certainly support you.

You can get capital from investors and other entities that provide funds if you are able to create something that appeals to them. The ecosystem must also support the failure of an entrepreneur. Even though the first try may fail, it doesn’t mean that you will make the same mistake again.

A good startup ecosystem should regard entrepreneurs who have failed before as experienced entrepreneurs. Many start-ups also prefer to hire entrepreneurs (even if they have failed before). This is not without reason, since in the early stages of a startup all employees must become entrepreneurs.

A startup is a high-risk business that even the smartest and most skilled team may fail. But if, for example, there are 20 startups with great teams and ideas that support each other (and even several other ecosystem entities that support them), chances are that some startups will grow to become international successes. This is why the startup ecosystem should be viewed as a whole, not through individuals, their success or failure.

Basically, a startup cannot grow in an empty space because it is meant to be a part of an entity. So it takes a special ecosystem to develop.

Startup Ecosystem Development Factors

In building a startup ecosystem, we need brilliant entrepreneurs, experienced investors and well-organized events. However, building a thriving startup ecosystem is not as simple as combining all of these elements. There are other factors that also determine the development of a startup ecosystem. Here are the other factors:

- Economic Climate

- Maturity and Risk

- Supervision and Special Treatment

The global and local financial climate, available markets (in other words: access to customers), international business relationships, maturity of the ecosystem, level of government incentives, and level of management of the startup ecosystem (including branding) can all determine the entrepreneurial activity an ecosystem can deliver.

Startups can almost never thrive in the midst of a global financial recession or during a national economic crisis. Strong international business relationships also play a big role. Therefore, strong international business relationships are essential for growing start-ups in smaller or developing countries.

Startup ecosystem will easily face different challenges with more established ecosystems. In a well-established ecosystem, it’s easy to take risks for greater returns. This is what is needed to build new startups and give investors a reason to take more risks.

Startup ecosystem with less government support will be difficult to develop. The best thing to develop a startup ecosystem is to do branding and build good relationships with international markets. Surely, all of this requires support from the government.

How to Build a Startup Ecosystem

Startups are often seen as a by-product of economic prosperity. However, the role of startups in economic development is very large. The potential to build a thriving startup ecosystem cannot only be done in developed countries.

Sometimes, it is the countries that need the most solutions to their problems that produce the most innovative startups. Therefore, special steps are needed in building a startup ecosystem. Here are the steps to build a startup ecosystem:

- Research and Mapping

- Building a Community

- Do Empowerment

- Establish Partnership

You can start by mapping the local ecosystem and researching the potential and problems contained in it. This will help you find or list resources and outline a framework for entrepreneurial activity in your area.

The next step is to start building a community. You can do this by joining or starting initiatives that promote interaction between local ecosystem members through group meetings or creating special events.

To be an entrepreneur, you need a supportive community in which to give each other feedback, resources, and contacts. Engage the community by incentivizing people who dedicate some of their time to building your local startup community. This is needed as an empowerment step to create meaningful change.

Leadership and collaboration are key. Be a leader and collaborate to accelerate the growth of your local startup ecosystem. Reach entrepreneurs, event organizers, nonprofits, schools, and even government agencies. Build partnerships to position yourself as a leader and help you build community.

By joining the right Startup Ecosystem, it is expected that the startup you are starting will develop even better. And most importantly when you want to create your own online startup, make sure the platform you choose can accept 24/7 and seamless transactions. Therefore, complete your startup with a payment gateway feature so that your user experience will be good.

You can choose Duitku as a licensed and trusted payment gateway in Indonesia. Duitku will help you manage customer transactions in real time with various payment options. Let DUITKU take care of your transaction!