The technology advancement has changed the shopping methods of many Indonesians. In the past, people tended to shop at physical stores or outlets, nowadays the majority of transactions are done online.

This change in shopping methods also has an impact on the business platforms. The ever-growing numbers of online businesses that provide a variety of products and services makes us compete to attract consumers and develop our business.

One way we can apply to facilitate business transactions is to use advanced payment systems such as payment gateways and disbursement. So, what is payment gateway and disbursement? What’s the difference? Let’s talk about it one by one!

1. What is Payment Gateway?

Payment gateway is a channel that has been connected to an authorized system that allows buyers to make payments directly from your online store. Interestingly, payment gateway allows your business to accept payments from various methods, from credit cards, bank transfers, e-wallet, even payments from the nearest supermarket or post office.

Because the system runs automatically, the digital transaction process becomes easier and faster. The easy payment facilitated by a payment gateway also has an impact on the increasing interest in shopping of the public. If you are good in seeking opportunities, you can use this to develop your business by giving various offers on your product.

The easiness in payment offered by a payment gateway and interesting offers is such a good combo you can apply to your business to attract new potential buyers!

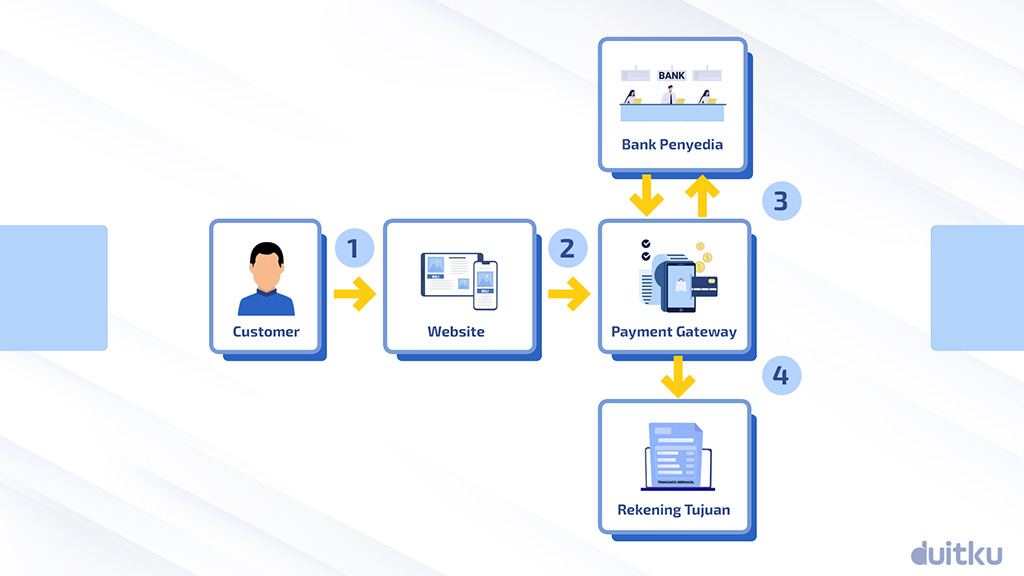

Then how does the payment gateway work?

- The buyer chooses a payment method and pays for the product directly on a website or an online shopping app

- Payment request is forwarded, and the payment is processed by a payment gateway

- Payment gateway forwards information to the destination bank or a payment service provider

- The bank or the payment service provider receives the request and sends a reply to the Payment Gateway system

- Payment gateway sends reply information in the form of “successful” or “failed” transaction status

- The transaction is recorded in the system and the merchant gets a notification of the transaction status. Then the purchase will be processed!

With a payment gateway, you can automate payment receipts on your website or online shopping app. After a payment is received, you will get a notification so that the purchase can be processed and your product can be delivered to your buyer.

2. What is a Disbursement?

Those who have experience in the financial industry must have heard the term ‘disbursement’ quite often. However, do you know what disbursement mean in this context?

In English, the term ‘disbursement’ refers to a payment or expense. Meanwhile, in the banking industry related to financial transactions, the term ‘disbursement’ depends on the context used. For example, Disbursement can be interpreted as a cash payment when a transaction takes place.

Disbursement by Duitku is a payment solution for various business partners in Indonesia. Using the API, transactions can be carried out in real time, accurate, fast, and no need for complicated manual input so that payment errors can be avoided.

How does disbursement work?

Disbursement is usually used by a marketplace or peer-to-peer merchants to distribute funds automatically. Here’s how money transfers work in a disbursement service:

- A user requests a withdrawal or transfer of funds directly on a website or an app

- If the website or the app receives the user request, the request for transfer of funds from the website or the app is forwarded to a payment gateway.

- The payment gateway forwards the information to the destination bank or a payment service provider to determine the authorization to send funds. Here, the payment gateway also performs a second check to ensure the recipient’s name and account number match to avoid wrong transfers

- If the authorization process is successful, the funds are distributed to the destination account in real-time

Then what is an example of the use of disbursement?

Disbursement is usually used by merchant marketplaces or peer-to-peer to channel funds automatically. The service are used for:

Processing Refunds or Payments to Third Parties

For instance, an e-commerce wants to channel funds to sellers, compared to manual transfer which takes a long time, e-commerce utilizes a system that automatically sends the balance according to the price of the product to the seller after the transaction is complete.

What’s interesting about disbursement is it can also be applied to a refund system in e-commerce. If the buyer wants a refund, the seller just has to agree to the refund request and the money will be sent automatically with the disbursement feature. This thing also applies to other financial instrument for buying and selling apps.

Withdrawing Funds from Website or Apps

Suppose you need funds worth 5 million and you decide to make a loan on a lending platform. After the loan requirements are met, the money will be automatically disbursed to your account through a system that has been integrated with the API. So, online loan platform owners don’t need to transfers the money manually! Just imagine, if an administrator has to verify and send the money manually one by one, it might take months for it to be sent.

With the disbursement service feature, the process will be quick and easy.

Payroll (Salary Payment)

Salary payment is usually done with a bank account. In fact, some companies are still doing salary transfers manually. Of course, this can be very time-consuming and difficult.

Now, companies can use the disbursement feature to manage employee salary payments. They just have to set the nominal in the system, and the salary will be transferred automatically to each employee’s account.

Disbursement is designed so that payment system integration can channel large amounts of funds with large volumes. Because it accommodates various payment needs of all customers, of course the system needs to be monitored according to Bank Indonesia regulations. This makes the feature only applies to legal entities or companies.

So that is the difference between payment gateway and disbursement. As a payment solution provider which offers a competitive price, Duitku provides two services to help online businesses in Indonesia, namely payment gateway and disbursement. If you want to receive payments from any method, you can use the payment gateway service.

However, if you want to send money to several people at once in real-time, you can use the disbursement service. Did you get a better understanding about disbursement and payment gateway now?

With the right payment gateway and disbursement service, payment in business can run automatically so you can focus on expanding your business growth. Let’s automate the payment process and start your success with one transaction with Duitku!